You are left with 400 units in your stock. But the market bought substitutes of 400 units. Imagine this, you forecasted that there will be a requirement of 1000 membrane filters in your territory for the next month. These substitutes affect the prices of the company, its demand pattern and therefore its profitability. In fact, many consumers prefer the use of substitutes over the original because of the low price and almost equivalent value added. However, what do you do when the threat of substitute products are too high? For example, whenever you consider spare parts of an automobile or even consumer durable, you will find a lot of substitute spare parts available. Porter’s five forces 2 – Threat of substitute productsĭo you know why China is one of the fastest growing nations in the world? Because of its manufacturing capability, and because of its smart strategy of making substitute products in millions, such that the original loses some of its value. Thus, an established player will see new entrants as a lesser challenge as compared to an existing competitor. To avoid new entrants, and to keep the industry profitable, the industry needs several entry barriers in place. For example – in the import export business, a lot of barriers exist with regards to government policy. The industry attractiveness increases when there are barriers to entry. That a new entrant will come who will try to win market share in an already intense industry. Even telecommunications brands, which have been shouting out to the government to stop giving more licenses, find this fear in their mind. And this threat exists in all industries. This was all because it is very easy to enter the dotcom market, but very tough to establish yourself in it.

The dotcom industry was expected to reap huge profits, but what we had was a lot of new entrants with failed business models attracting a lot of money. Porter’s Five forces 1 – Threat of new entrantsĭo you know why the dotcom industry went bust in 2000? Because anyone, absolutely anyone, was starting a website and attracting investors. Each individual force of the external business environment is discussed below. And these five forces affect each of the competitors present within that industry. As the name suggests, there are five different forces which play a role in the industry. The Porter’s five forces analysis modelĪbove is a simplified image of the model of Porter’s five force analysis. Thus, using above examples, you can analyse the attractiveness of any industry with the Porter’s five forces analysis model. Thus, the overall profitability is low in the industry and the threats of substitutes, the competition and the bargaining power of customers has to be taken into consideration before establishing yourself in the consumer durable industry. Furthermore, there are a lot of substitutes in the consumer durable industry with chinese brands mass manufacturing alternative products. And if the dealer network has high bargaining power, this means that the dealers are cash rich and hence entering such a segment is difficult for your company. Thus, the net result is that you should avoid entering an industry which is unattractive or at least take the precautions while entering such an industry, where profitability is low. The concept of attractiveness can be clearly understood in the consumer durable business.Īs we know, in consumer durable, the toughest competition is between companies which have a good customer base (dealer network). On the other hand, the industry is said to be unattractive if all the five forces are interconnected in such a manner that they cause the profitability of the company to drop.

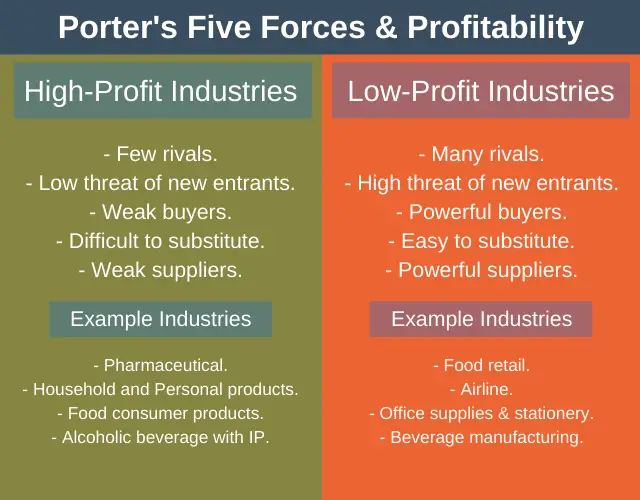

An industry is said to be attractive if the five forces are arranged in such a manner that they drive profitability. The key driving force behind Porter’s five forces model is to determine attractiveness of the industry. The concept of Attractiveness in Porter’s five forces model. The dynamic nature of Porter’s five force of competitive analysis.Porter’s Five forces 5 – Intensity of rivalry.Porter’s Five forces 4 – Bargaining power of suppliers.Porter’s Five forces 3 – Bargaining power of Customers/buyers.Porter’s five forces 2 – Threat of substitute products.Porter’s Five forces 1 – Threat of new entrants.The Porter’s five forces analysis model.The concept of Attractiveness in Porter’s five forces model.

0 kommentar(er)

0 kommentar(er)